s corp dividend tax calculator

Dividend Tax Rates for the 2021 Tax Year. Normally these taxes are withheld by your employer.

Taxtips Ca Business 2020 Corporate Income Tax Rates

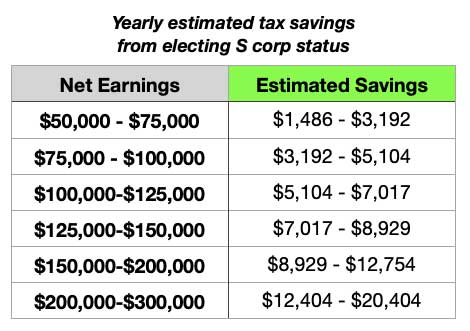

As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

. 2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which are only taxed at the shareholder level. Because an S corporation is not taxed on these profits as corporate income it avoids. Dividend Tax Rates for the 2021 Tax Year.

For example if you pay out 50000 in distributions and person A owns 50 percent of the S Corporation person B owns 30 percent and person C owns 20 percent. If you earn over 150000 or more across all sources of income you pay 3935 tax on the dividends you earn over 2000 per tax year. Person C would receive 10000 in distributions.

Ad Our Resources Can Help You Decide Between Taxable Vs. We have used this code in our calculations. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

This tax calculator shows these values at the top of your results. Dividend income is taxed as follows. The leftover funds are distributed as dividends which are taxed again on the individual shareholders personal income tax return.

If the income is considered capital gains or dividends you would pay a lower tax rate ranging from 0 percent to 20 percent. 0 12570 0 personal allowance 12571 50270 75. An S corporation is not subject to corporate tax.

The S Corp also files a Schedule K-1 for each shareholder reporting their individual profit or loss and gives a copy to each shareholder. If income is standard income you would pay the standard income tax rates. The Personal Allowance for 2122 is 12570 tax code is 1257L.

So at a personal income level of 125140 your entire personal allowance would have been removed. Its also possible you get a Schedule K-1 if you invest in a fund or exchange-traded fund ETF ETF that operates as a. Ad Calculate the impact of dividend growth and reinvestment.

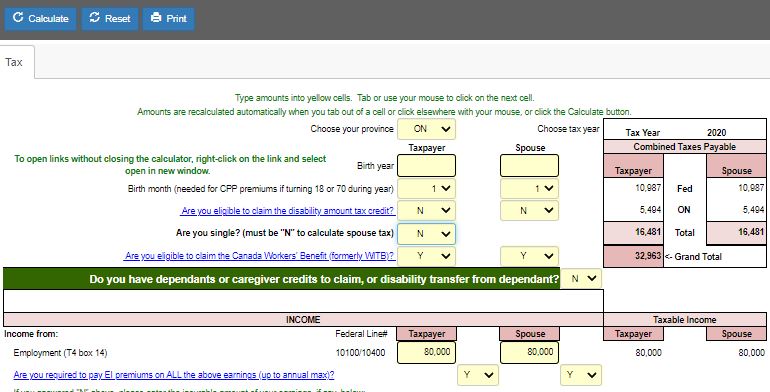

Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. We have used this code in our calculations. With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend payments that you make.

But if the income is long-term capital gains or qualified dividends you pay the lower preferential tax rates sometimes 0 usually 15 and worst-case 20. Annual cost of administering a. For example if your one-person S corporation makes 200000 in profit and a reasonable salary is 80000 you will pay 12240 153 of 80000 in FICA taxes.

If an S corp allocates 125000 profit to you the shareholder the character of such income is important. Enter the total amount of your salary which has been put. Income is taxed only once when the income is earned by the S corporation whether the income is reinvested or distributed.

If your income is greater than 100000 your personal allowance benefit is cut by 1 for every 2 you earn above the threshold. To use our calculator simply. Unlike partnerships S corporations are not.

Person A would receive 25000 in distributions. Say for example that you get 125000 of income from an S corporation. The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800.

S corp dividend tax calculator Tuesday March 1 2022 Edit. For example if you pay out 50000 in distributions and person A owns 50 percent of the S Corporation person B owns 30 percent and person C owns 20 percent. Our S corp tax calculator will estimate whether electing an S corp will result in a tax.

S corp dividend tax calculator Tuesday March 1 2022 Edit. S Corporation Distributions. Simply fill in the yellow boxes as indicated and the calculator will work out how much post-tax profit is available to distribute as dividends.

50000 of ordinary business profits. Person B would receive 15000 in distributions. The S Corp filing deadline is March 15 and like your individual return a 6-month extension can be applied for.

Or other income from a trust estate partnership LLC or S corporation. The S corporation will issue a shareholder a Schedule K-1. Im an additional rate taxpayer what do I pay.

Any remaining business profits are distributed to owners as dividends. This calculator has been updated for the 2022-23 tax year. You should pay this via a Self Assessment by 31st January following the.

Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations. 875 of Dividend Income for income within the Basic Rate band of 20 3375 of Dividend Income for income within the Higher Rate band of 40 3935 of Dividend Income. Say for example that you get 125000 of income from an S corporation.

Income Tax Calculator. Total first year cost of. Dividends are paid by C corporations after net income is calculated and taxed.

If the income is ordinary income you pay the ordinary income tax rates. Each year the S Corp must file a corporate tax return called Form 1120-S. If an S.

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How Are Dividends Taxed Overview 2021 Tax Rates Examples

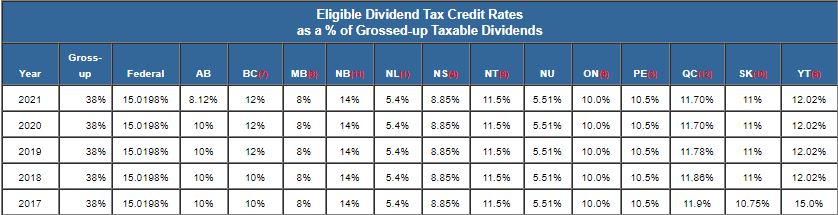

How The Dividend Tax Credit Works

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Determining The Taxability Of S Corporation Distributions Part I

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Tax Calculator With Dividends Store 60 Off Www Fanat1cos Com

Corporate Class Swap Etf Tax Calculator Physician Finance Canada

Tax Calculator With Dividends Store 60 Off Www Fanat1cos Com

Ontario Income Tax Calculator Wowa Ca

Tax Calculator With Dividends Store 60 Off Www Fanat1cos Com

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

S Corp Vs Llc Difference Between Llc And S Corp Truic

Taxtips Ca Dividend Tax Credit For Eligible Dividends

Taxtips Ca 2020 Canadian Income Tax And Rrsp Savings Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download